Socially Responsible Investing Will Soon Be The Norm

For the average investor, I am a strong proponent of investing in a diversified set of low-cost index funds which likely provides market-matching returns over the long run (or damn near close to it). Even though most investors under-perform this easy to achieve benchmark, many cannot help but try their hand at beating the markets because they do not want to settle for “table stakes.â€

Given the reality that our cognitive biases, overconfidence, and desire to have fun in the markets frequently supplant our rational judgment when it comes to investing, why not make a positive expected value (I assert) bet with positive externalities? To this end, I recommend socially responsible investing as a way to “play the markets,†do real good, and potentially earn superior returns.

There is a growing body of evidence that suggests that socially responsible investing (SRI) has the potential to outperform conventional portfolios over time and the purpose of this post is to provide a quick overview of logic that supports this argument.

Go to where the money will be.

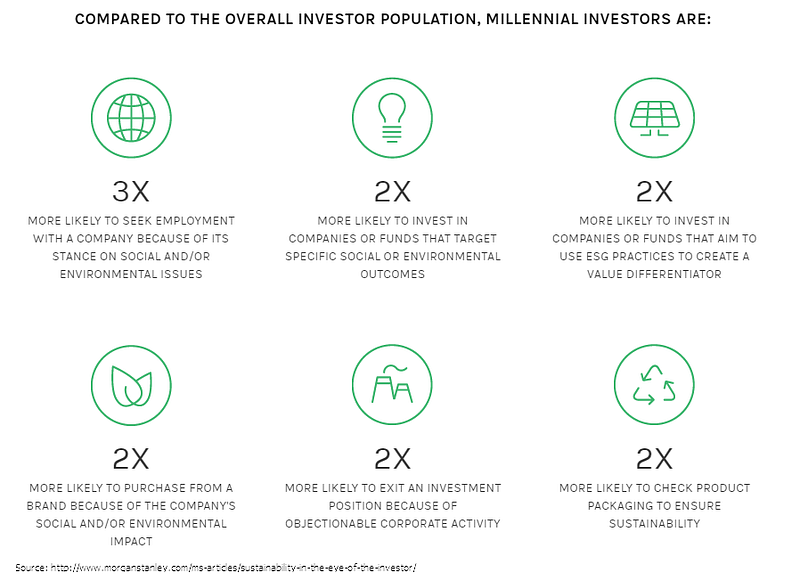

Between today and my retirement, there is an estimated $30 Trillion of wealth that will transfer to millennials with almost $3 Trillion of that coming in the next 4 years. Pair this with the fact that millennials are 2x more likely to invest in companies that target specific social or environmental outcomes, and the fact that they are 2x more likely to exit an investment position because of objectionable corporate activity, and you are left with a large number of dollars that will systematically flow into socially responsible companies and out of objectionably behaved companies.

This story by itself, if you believe it, is enough to generate a sensible investment thesis that is bullish on socially responsible organizations. The icing on the cake (gluten free and organic, of course) is that these large flows of capital have the potential to create powerful, self-reinforcing engines: cash flowing to these businesses lowers their cost of capital, increasing their efficiency (or growth potential if you don’t buy efficiency), and generating superior returns that in turn attract more investors.

Too clean to fail.

With the growing importance of these issues as expressed by millennials as well as scientific facts (global warming, water scarcity, etc.), it is not unreasonable to think government subsidies for sustainable practices, both in terms of dollars and regulatory benefits, will continue to grow considerably in coming years.

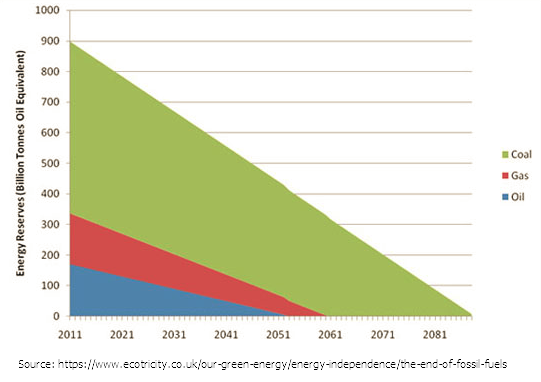

Furthermore, there is strong evidence to suggest that the world will be afflicted with increased scarcity of resources (water, oil, fossil fuels) in our lifetimes. Business that begin to slowly shift to more sustainable practices will be well ahead of rising resource costs and business disruptions from supply shocks.

Socially responsible investing outperforms empirically, too

There is a study that studied studies that studied the relationship between environmental, social and governance (ESG) criteria and corporate financial performance (CFP). In total, some 2000 studies were evaluated. A staggering 90% of the studies suggests non-negative correlation between ESG and CFP. Put differently, 90% of the studies reviewed indicate that socially responsible companies perform equal to or better than those who do not follow that criteria.

While there are macroeconomic and regulatory tailwinds for ESG-positive companies in the coming years, historical evidence has already provided significant evidence of financial out-performance. While the basket of low-cost index funds may be “the market†of today, there is reason to believe that it will under-perform the “new market†of tomorrow that is more accepting of ESG-criteria. Do you want to be left behind? And implicitly support the destruction of the earth? Of course not.

Disclosure: I recently became an adviser to OpenInvest, a Y Combinator-backed startup whose mission is to make socially responsible investing the norm.