Wealthfront vs Schwab Intelligent Portfolios: A Third Take

Recently Adam Nash, the CEO of Wealthfront published a piece on medium lamenting how Charles Schwab lost its way, citing the launch of the Schwab Intelligent Portfolios (SIPs) as evidence. Soon thereafter, Charles Schwab responded, calling part of Nash’s example “criminal” (a trope used by Nash himself to describe Schwab’s approach). In this article, I’ll breakdown the arguments and illustrate how even in the best case scenario for Charles Schwab, their SIPs are still a bit worse than Wealthfront’s portfolio.

The Wealthfront Argument:

1. The SIPs hold sub-optimally large cash balances.

2. Schwab pays a sub-market return on those cash balances.

3. SIPs are self-serving because they use a sub-optimal asset allocation to funnel assets into Schwab’s preferred funds.

4. SIPs preferred “Smart Beta” ETFs have high fees that are not justified by the value smart beta adds.

The Charles Schwab Argument:

1. SIPs cash balances are totally reasonable sizes. Good portfolios have cash balances.

2. Smart beta portfolios are acceptable and outperform traditional market-cap weighted indices.

The Cash Question

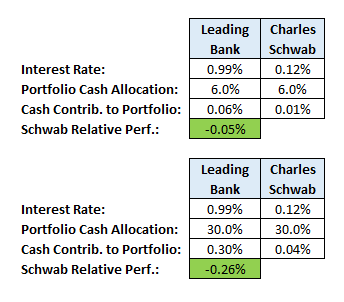

Nash says SIPs cash balances are too high. Schwab says they’re reasonable. Who do you believe? It turns out the more important fact is Nash’s 2nd argument that Schwab pays a sub-market return on cash balances, a claim unrefuted by Schwab. According to Nash’s figures, Schwab pays 0.87% less on it’s cash balances than a leading competitor bank (0.99% vs 0.12%). SIP’s with a 6% cash balance and a 30% cash balance create a 0.05% and 0.26% drag on the entire portfolio (relative to the leading competitor bank) because of Schwab’s stingy interest paid on cash balances. This is illustrated in the table below.

If Schwab was truly trying to be consumer friendly, they could have chosen 1 of 2 approaches that would remain consistent with their viewpoint that moderate cash balances are prudent investing strategy (i.e. if you disagree with Nash’s view that low cash balances are better):

- Schwab could use the Wealthfront approach by keeping minimum cash on hand and encourage clients to leave moderate cash balances (that are currently being held in SIPs in the sweep allocation) in their external accounts with higher interest rates. This would meet Schwab’s “cash balance is prudent” requirement as well as provide optimal cash return to the client.

- They could just offer a competitive interest rate on cash balances.

But they chose to do neither which leads me to conclude that Nash’s explanation probably rings true: “follow the money.”

Asset Allocation: A story of mis-aligned incentives

Wealthfront’s fee is charged for the management of a portfolio of ETF’s. The management includes smart asset allocation, optimized rebalancing, and automated tax loss harvesting. To earn it’s management fee, it is in Wealthfront’s best interest to select a low-cost and appropriately diversified set of ETF’s — so the portfolio performs well, clients stay happy and the asset base grows (benefitting both Wealthfront and the client). This is a dream incentive alignment for clients.

Schwab’s Intelligent portfolios on the other hand, are mired in some incentive alignment issues. While SIPs fee structure also incents asset base growth, there is also a strong incentive to steer clients towards Schwab products, and expensive Schwab products in particular. In fact, SIPs allocate a large portion of assets (I have seen 60% quoted in some places) to Schwab’s own smart beta products. These smart beta products average an expense ratio of ~0.35%, roughly 3 times the cost of Vanguard ETF’s used by Wealthfront.

The tough question is whether Wealthfront’s asset allocation is better or worse than Schwab’s asset allocation. Schwab makes the claim that their smart beta portfolios do indeed outperform traditional asset mixes, though I have yet to see definitive evidence of this or even a quote on the magnitude of the difference in performance. Some in-depth analysis (which I’d love to see Wealthfront or Schwab actually do) will be required to answer this question. What I can say though is that it seems a little too convenient to me that SIPs utilize Schwab’s high-priced products in such large quantities.

Conclusion

In the best case scenario you believe that (1) Schwab is not nudging allocations to their benefit and (2) a reasonable cash balance should be held in a portfolio. Unfortunately, even in this base case scenario, SIPs still slightly underperform a Wealthfront portfolio.

The Wealthfront portfolio costs 0.25% plus the underlying cost of the ETFs (~0.12%) for a total annual expense ratio of ~0.37%. We’ll assume that we invest 90% of our cash in this portfolio and 10% in cash at a leading competitor bank. This means the fee we pay to Wealthfront is 0.33% (0.37% fee * 90% of portfolio) and we earn a 0.10% contribution to the portfolio from cash (10% balance at 0.99% interest).

While SIPs have no management fee, they do allocate to underlying funds costing 0.20% – 0.40%. If we take an average SIP, we’ll pay 0.27% in fees (0.30% underlying fund costs * 90% invested) and we will earn a 0.01% contribution to the portfolio from cash (10% balance at 0.12% interest).

What this nets out to is that the Wealthfront portfolio is 0.06% more expensive in fees, and earns you 0.09% more in cash return, netting out to a 0.03% advantage for Wealthfront in the most bullish scenario for the Schwab Intelligent Portfolios. Plus, don’t forget Wealthfront’s Tax Loss Harvesting on all taxable portfolios (Schwab has a significant minimum balance requirement for TLH).

Now, at the end of the day, if you’re not investing your money because you can’t decide between Wealthfront, Betterment, Schwab Intelligent Portfolios, or Wise Banyan — you should just roll a damn 1d4 (if you don’t have one, I’m happy to roll mine for you) and pick one, because they’re all far better than your cash sitting in a checking account.