Variable Dollar Cost Averaging (VDCA)

Investing Psychology Matters

Fear and greed drive us to make bad investment decisions. One way to protect ourselves is to have a system and stick to it. This is one reason I love dollar cost averaging (DCA), which is a system to trade a small expected gain in exchange for a big reduction in point in time risk. Read more about it here if you aren’t familiar with it.

Over time, variable DCA is likely not any better or worse than regular DCA, though there will be individual variation. I recommend the system because it is easier to stick with when markets are tumultuous. The idea behind VDCA is simple: Invest less when assets are expensive and invest more when assets are cheap.

Decide how much and how often to invest

First, we’ll need to make some decisions on how we much we want to invest, how often we want to invest, and how complicated we want our system to be.

-

1) How often will you be making an investment? Ex: I will be contributing to my investment portfolio once every 2 weeks.

2) What is the average amount you want to invest per period? Ex. I will contribute $100 on average every two weeks. The exact amount will, however, vary week to week.

3) How many possible investments amounts do you want? Ex. I will either invest $50, $100, or $150. You can be as coarse or as granular as you like. Simple is often better.

Create your VDCA system

Now, we do some quick analysis to set up our system. In my example, I will be contributing on average $100 to my portfolio every two weeks and will do this with one of three investment amounts ($50, $100, or $150). You can set whatever parameters you like.

-

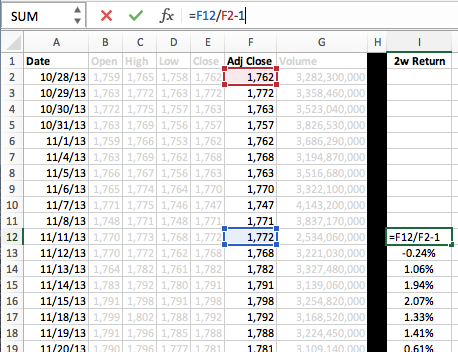

1) Find and download the historical returns of your portfolio. The more data you have, the better. If you don’t have your portfolio returns, you can use the return of the S&P500 since most portfolios are essentially the same.

2) Calculate the historical returns for your investment frequency (e.g. 2-week periods). Note: This frequency does not need to be the same as your investment frequency, but it makes things simpler. I’m also ignoring auto-correlation here — it doesn’t matter a lot.

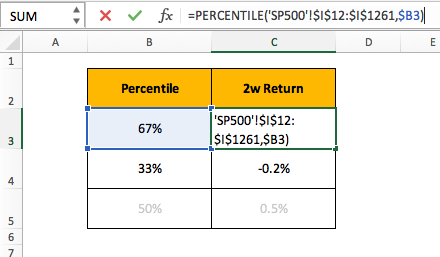

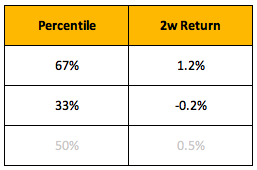

3) Split the returns into the number of investment amounts you will be using (e.g. 3). We can do this using percentiles (e.g. 67th and 33rd) to split our 2-week returns into 3 buckets. Note: Effectively, we’re using percentiles to make the buckets equal in frequency (sort of), though this isn’t necessary. Roughly a third of the time we’ll see a return above 1.2%, a third of the time we’ll see a return between -0.2% and 1.2%, and a third of the time we will see a return below -0.2%.

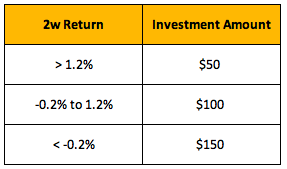

4) Apply your investment amounts to the appropriate buckets. If the market is up a lot (bucket #1), we’ll only invest $50 and if the market is down a lot (bucket #3), we’ll invest a full $150. On average, however, we should be investing about $100 every 2 weeks.

5) Remind yourself to quickly check returns and make your investment. For example, you could put a calendar reminder every 2 weeks to make a deposit into your Wealthfront account. That’s it. You’re done.

Tweaks to make to your VDCA for fun

VDCA is merely a system to help you invest in the markets consistently. You’ll invest a little more when the markets are down and invest a little less when the markets are up. The specifics of how you do this matter much less than actually sticking to your plan through thick and thin and making the system work for you. Below are some modifications that you can make, should you so choose to.

1) If your portfolio materially differs from the S&P500, use the historical returns of your portfolio instead of those of the S&P500. And no, the 10% in bonds don’t help! Use these 2-week returns to set your percentile buckets instead.

2) Tweak the variable and fixed splits. In our example, we are essentially making a fixed $50 investment every 2 weeks. On top of that, we make a variable investment of $0, $50, or $100. You may tweak this mix however you like. Isn’t it great that whether the market is up or down, you’re always investing (except a bit more when it’s down and a bit less when it’s up)?

3) Add more buckets and granularity to your investment amounts, if you really feel like it. Instead of having 3 investment amounts, you can have 4 or even 5. Don’t get too complicated.

4) The buckets don’t have to be equal sizes. You could invest $50 if the market has a top 20% return (80th percentile) and invest $150 if it has a bottom 20% return (20th percentile) and then invest $100 the other 60% of the time (20th to 80th percentile). If you do this, don’t forget to update your expected weekly investment calculation: in other words you will be investing $100 3 times more frequently than you will be investing $50 or $150.